Basing contributions on earnings from first £1, without the current £6,240 offset, boosts funds by thousands for savers of all ages. Removing offset could boost 22-year-old’s retirement fund by £93,400. 18 year-old employees will be double winners with earlier auto-enrolment age allowing 4 years extra contributions and growth, potentially benefitting them by £150,000 at age 68.

The Government has now enacted the new Pensions (Extension of Automatic Enrolment) Act 2023, heralding two key future enhancements to auto-enrolment. From a future date, still to be agreed, minimum contributions from both employers and employees will gradually increase to 8% of earnings from the first £1, rather than being based on 8% of earnings over £6,240 per year.

Secondly, employees will in future be auto-enrolled into their employer’s workplace pension scheme from age 18 rather than having to wait until they reach age 22.

The removal of the £6,240 ‘offset’ will provide a major boost to workplace savers of all ages, with those further from retirement benefitting most. While the detailed timetable and a likely phased approach is still to be consulted on, a 22-year-old could boost their retirement fund at age 68 by £93,400 (£37,500 in today’s money after allowing for the effects of inflation). This will mean a small increase in personal contributions, equivalent to £20.80 per month for a basic rate taxpayer, which will be introduced in stages.

Table 1 shows the extra fund value individuals of various ages could receive by age 68.

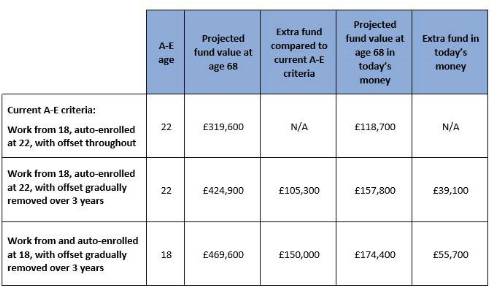

The biggest winners are those joining the workforce at 18 years old. They could gain £105,300 from the removal of the offset, and a further £44,700 from being automatically entitled to an extra 4 years of pension contributions and investment growth. In total, this could lift their retirement funds at age 68 (their expected state pension age) by £150,000 (£55,700 in today’s money).

Table 2 shows how someone joining the workforce at age 18 might benefit.

Steven Cameron, Pensions Director at Aegon, said: “The auto-enrolment changes are great news for pension savers and will, over time, lead to scheme members having significantly more in their retirement pots.

“The gradual change to basing contributions on earnings from the first £1, rather than only on earnings above £6,240, will have wide-ranging benefits. Many schemes base pension contributions on the minimum definition of earnings above £6,240 and everyone in such a scheme will see a rise in contributions, boosting their retirement funds. While this will mean personal contributions also increase in stages, the maximum increase for a basic rate taxpayer will be £20.80 a month, or around £5 a week, but this is worth twice as much in their pension after employer contributions and Government tax relief.

“The change will benefit workplace savers of all ages, but those with longer until retirement will see the biggest gain. Based on the offset being gradually removed over three years, a 22-year-old could see their pension value boosted by £93,400 (£37,500 in today’s money) by age 68.

“For a 30-year-old, the increase is £59,200 (£27,900 in today’s money). The boost for a 40-year-old is £31,300 (£18,000 in today’s money). And for a 55-year-old, their fund value at age 68 could be £8,600 higher (£6,600 in today’s money) than it would be if the offset applied throughout their time saving.

“One group who will be ‘double winners’ are those joining the workforce at age 18. At present, employers needn’t enrol employees until age 22, but the changes will now see all employees earning over £10,000 a year auto-enrolled from age 18. This will mean younger employees automatically benefit from up to four years extra of contributions and investment growth.

“If the current offset is gradually removed over three of those four extra years, an 18-year-old earning £20,000 per year could achieve a pension pot of £469,600 (£174,400 in today’s money) upon reaching 68. This is a huge extra £150,000 (£55,700 in today’s money) over what current rules might produce, where an individual isn’t auto-enrolled until 22 and is subjected to the offset throughout.”

Table 1 – Difference in projected fund value at 68 years old as a result of phased removal of salary offset, dependent on age when auto-enrolled

Table 2 – Projected fund value at 68 years old, dependent on changes to earliest auto-enrolment age and salary offset rules*

Assumptions

* Investment growth of 4.25% (after charges)

Inflation of 2% over the long term

Earnings grow at 3%

Assume offset to rise with inflation, although Government has kept this unchanged since 2020/21

Assumed the offset falls to £5,000 in first year, £2,500 in second, removed in year 3

Assumed 18-year-old to have a starting salary of £20,000 (current average for 18 to 21-year-olds)

|