But while retirement may seem a long way off for millennials, it’s the youngest workers who could actually see the greatest uplift in their state pension over the long term if the triple lock was protected. The uplift does come with a cost however, taxpayers today will also be the ones who’ll pay most towards it in the short term.

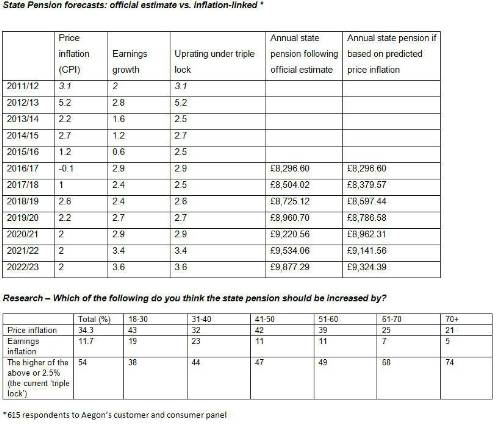

The triple lock has proven valuable in recent years while both price inflation and earnings growth have remained low. Official estimates show that if the triple lock were to continue to 2022/23, the state pension would be worth £9,877.29, although this assumes that average earnings growth will be strong in the years to come, and the 2.5% uplift will not even be required.

The research showed support amongst younger groups for state pension to be increased only with price inflation. On this basis, the same official statistics show the state pension rising to £9,324.39 over the same period, a difference of more than £550.

Steven Cameron, Pensions Director at Aegon said: “The triple lock is one of the key policy issues of the election debate with parties split on whether it should be continued beyond 2020. Our research has found that those aged over 60 strongly support its continuation, while the younger generation are more in favour of a link simply to price inflation.

“In some sense, offering less generous increases to the state pension would benefit younger age groups. State pensions are not funded in advance, so it’s the income tax and National Insurance contributions of today’s working population that are funding the payments those in retirement receive. However, in the long run younger workers could miss out from a pension that is constantly uprated by a minimum of 2.5% before and after they retire. These findings highlight the intergenerational impacts that policy changes can have not just now but also in the future as people’s priorities change over time.

“Trying to predict economic data is difficult at the best of times but with Brexit negotiations to come, the outlook is perhaps more uncertain than ever. What these figures do show however is that small changes to the uprating will compound over time. This may look attractive to those receiving the higher amounts but its younger generations who’ll bear the costs.”

|