• IPT adds £18.80 to average quoted premium

• Young drivers bear misery of £42 tax rise

• AA warns of uninsured and ‘pseudo-insured’ drivers

Young drivers are those least likely to be able to afford the tax hike, which most insurers are expected to pass on to customers.

The average quoted premium for those aged 17-22 is £1,278, which will rise to an eye-watering £1,319.35 after the tax increase.

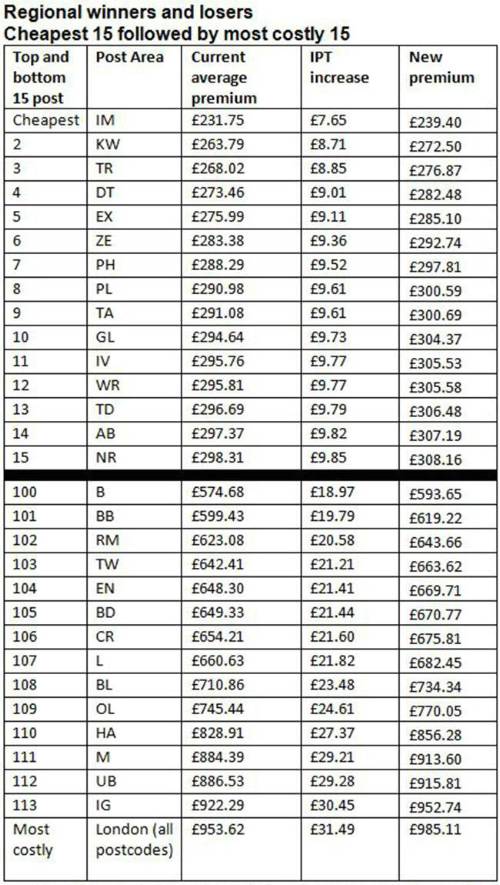

And those living in London, who are already typically quoted the highest average premiums in the UK at £953.62**, will see this figure rise by £31.49 to nearly £1,000 thanks to IPT.

Janet Connor, managing director of AA Insurance, says that the IPT increase could not have come at a worse time.

“Back in July following the Chancellor’s Budget announcement of this stealthy and unexpected tax imposition, the Treasury seemed taken aback when the AA warned them that premiums were expected to rise quickly over the rest of 2015.

“Already, premiums have risen by nearly 10% over the past six months and the IPT rise will only pile on the misery.

“We have lobbied the Treasury on this issue calling for ministers to think again – or at the very least, exempt young drivers from the tax for at least the first year of buying their first car insurance policy.

“We believe that the tax increase will encourage some young drivers to attempt to drive without insurance.”

However, Ms Connor also warns of a sinister rise in ‘pseudo insured’ drivers.

“Given the number of police cars equipped with automatic number plate recognition (ANPR) technology, uninsured drivers are more likely than ever to be stopped and prosecuted; with their car confiscated.

“To avoid losing their cars, we believe that more drivers will attempt to falsify information to achieve the lowest possible premium.

That might include changing age, occupation, even name and address – in fact the only accurate information might be the registration number of the vehicle,” Ms Connor says.

“In that way the vehicle will be recorded as ‘insured’ on the Motor Insurance Database and will thus avoid being stopped by ANPR-equipped police patrols.”

But she points out that insurers are wise to this scam and adds that such motorists still risk prosecution. What’s more, routine police checks will quickly uncover the fraud attempt.

“Insurers, who would be liable for third-party damage and injury costs in the event of a collision, will press for prosecution but if the number of such cases rises substantially, adding to insurers’ costs, it can only lead to further upward premium pressure.”

Above table based on AA British Insurance Premium Index ‘Shoparound’ figures: an average of the five cheapest premiums returned for each ‘customer’ in a nationwide basket of risks. Figures from direct, broker and price comparison site returns

Based on Broker Shoparound weighted premiums. Source: Premium Insight software, using average quotes from each post town

|