A new in-depth consumer insight programme from Just Group, the retirement specialist and GenXpert, uncovers the drop in average pre-tax household incomes as Gen X nears retirement and many begin to move into part-time work or out of the workforce altogether.

Within Just Group’s wider GenVoices programme, a survey of more than 3,000 Gen X adults (those born between 1965 and 1980) provides a comprehensive understanding of the lived experiences and attitudes of this generation. Sandwiched between Boomers and Millennials, Gen X is often overlooked but represents almost 14 million people2 in the UK, around a quarter of the total adult population.

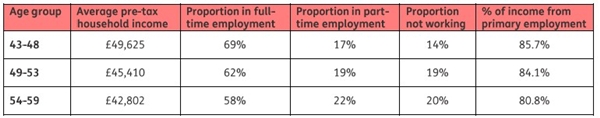

The data shows a clear decline in average pre-tax household income as Gen X ages. Those aged 43-48 receive an average of £49,625 in income from all sources including wages earnt from both them and their partner if they are in a relationship. This declines to £45,410 among those aged 49-53 and falls even further to £42,802 among 54-59 year olds.

The decline in average pre-tax household income appears to be driven by Gen X either moving to part-time work or out of the workforce altogether as they get older – whether that is a voluntary choice or not. The proportion in full-time employment falls from 69% among the 43-48 age group, to 62% among those aged 49-53 and then further to 58% for 54-59 year olds.

Meanwhile one in five (20%) of the oldest Gen X age group said they were no longer working compared to only 14% of 43-48 year olds, and over a fifth (22%) of the oldest group had gone part-time compared to 17% of the youngest age group.

“We are seeing average incomes drop significantly as Gen X households get older alongside a notable decrease in the proportion of those working full-time,” said Stephen Lowe, group communications director at Just Group.

“The key question raised by this trend is whether the older members of Gen X jumped or were they pushed from the labour market? Are they choosing to transition into retirement by reducing hours or leaving work entirely to get a better work-life balance? Or, are they forced out of work or into lower paid jobs due to factors like ill-health, redundancy or difficulty finding suitable jobs? The latter scenario would raise a serious red flag over their longer-term financial security as it suggests a possibility of reduced pension contributions at a critical phase in their life. Those who find themselves unable to get back into work may be forced to dip into their pension savings early and thereby run the risk of diminished retirement savings.” he said.

The statistics reference pre-tax, whole-of-household earnings so may reflect one member of the household cutting down on their working hours as one full salary becomes enough to sustain their standard of living.

“Additional data from this research project on Gen X showed a growing desire for a better work-life balance and that may be a key indicator suggesting Gen X are able to transition their working lives towards a life after work, Of course, it is imperative that people have a good understanding of how their finances will support them when they start their life after work and have made adequate preparations to ensure a good standard of living throughout their retirement. The Government’s free, independent and impartial guidance service PensionWise is a great place to start to get to grips with planning your finances for retirement," said Stephen Lowe.

|