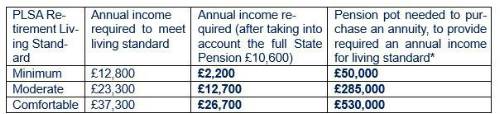

New analysis by Standard Life, part of Phoenix Group, using the MoneyHelper annuity tool, reveals the pension pot needed to secure a ‘minimum’, ‘moderate’ and ‘comfortable’ standard of living in retirement.

Retirees who want to achieve a minimum living standard in retirement, which includes enough for the basics and one week’s holiday in the UK a year but no car, require an annual income of £12,800, according to the PLSA1. Assuming a full state pension (£10,600 a year) is received, a retiree requires an income of £2,200 each year to maintain this standard of living. In order to buy an RPI linked annuity - which is a guaranteed income for life - they would need to have amassed around £50,000 in retirement savings at current rates. People looking to retire earlier than the State Pension age, which is currently 66 and rising to 67 between 2026 and 2028, will need to bridge the gap in full amount from any private pension pot or additional savings.

Meanwhile, for a moderate retirement standard of living, which allows for a car and one foreign holiday a year, the PLSA calculates an income of £23,300 per year is needed. Assuming a full state pension is received, a retiree would need an annuity which provides £12,700 a year and would therefore currently need to save around £285,000 to secure this.

For a comfortable living standard in retirement, pensioners would need to amass a pot of around £530,000.

Retirement savings needed to secure an annuity – guaranteeing an income for life:

* Figures assume retirement at the age of 66, single life annuity, no guarantee, paid monthly in arrears, linked to RPI, non-smoker with no underlying health conditions.

Dean Butler, Managing Director for Retail Direct at Standard Life said: “Thinking about the amount of money you need to retire can be daunting, but having a savings target in mind gives you something tangible to work towards. The Retirement Living Standards tool from the PLSA clearly shows what life in retirement looks like at different levels, factoring in the expenses people tend to forget like birthday money for loved ones as well as the more obvious costs.

"It’s important to note these figures are just a guide, and individual circumstances will vary. Life costs more in different parts of the country, for example, and the figures don’t account for housing costs which a significant minority of retirees currently have and which more are predicted to have in the future as longer-term mortgages surge in popularity. However, knowing that £285,000 is the amount needed for a moderate retirement is a good place to start, and highlights the importance of consistent saving. Starting to save for retirement as early as possible in your career really helps, giving you more time to build up a decent pot, and a greater chance of taking advantage of possible compound investment growth.”

Annuity rates on the up

Annuity rates have improved by 20% in the last year, meaning people are getting much more value for their money. The benefit of an annuity is that it gives you a guaranteed income for life, that won’t change, as opposed to drawing down your pension, where returns aren’t guaranteed. In today’s uncertain economic climate, the certainty and security that an annuity can offer is certainly worth considering as part of your retirement toolkit.

Dean Butler said: “On a more positive note for people looking for a guaranteed income for life to match their target retirement living standard, the current economic environment has pushed annuity rates up, with Standard Life estimating rates have improved by 20%2 over the last year, meaning pensioners can generate larger incomes from their savings. The value and certainty offered by a guaranteed income seems to be becoming harder to ignore.”

|