|

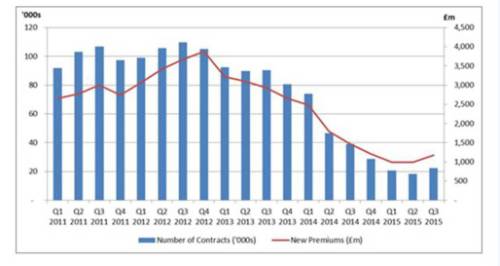

Annuity sales have seen their first quarter on quarter increase for the last three years, with 22,380 sold, worth £1.17bn in the third quarter of this year compared to 18,200, worth £990m last quarter. The last time there was a quarter on quarter increase was Q2-Q3 2012 (see graph below).

The figures show, for pay outs:

-

£2.5bn has been paid out in 166,700 cash lump sum payments, with an average payment of just under £15,000.

-

£2.2bn has been paid out via 606,000 income drawdown payments, with an average payment of £3,600.

For funds being invested:

-

£2.85bn has been invested in 43,800 income drawdown products, an average fund of almost £65,000.

-

£2.17bn has been invested in around 40,600 annuities, making the average fund invested nearly £53,300.

Our data also shows that people are shopping around to find the best deal with 60% of people changing provider when buying an income drawdown policy. This compares to 40% of customers who bought an annuity, where customers are often offered guaranteed annuity rates by their existing provider.

Announcing these statistics at the ABI’s Biennial Conference, ABI Chairman Paul Evans said:

“We’ve responded exceptionally well to the new Retirement Freedoms. The ABI has announced today that in the first six months, customers have received £2.5bn from their pension savings as a cash lump sum – averaging £15,000 each. In the same period customers have invested £5bn to buy an income – averaging £60,000 each.

“As expected, customers are taking smaller pots as cash and using larger pots to secure an income – about 40% with an annuity and 60% with a flexible income drawdown product. Around half are now switching away from the company they saved with to secure the best deal for their retirement income. Overall, customers appear to be behaving rationally, and I think we can all be proud of the speed with which we responded to help the Government's reforms succeed.”

The ABI’s Director for Long Terms Savings Policy, Dr Yvonne Braun, said:

"The peaceful pension revolution continues. While providers continue to meet high levels of demand, it’s clear that people are taking a sensible approach and considering how they will pay for their retirement.

“Despite some ringing the death knell for annuities, this seems to have been premature. An increasing number of people are recognising the value of a guaranteed income, with annuity sales rising this quarter. There are also initial signs that the number of people accessing their pension pot as cash is beginning to settle down, with larger pots continuing to be used to buy retirement income products.

“However, the figures also show that ensuring people save enough for retirement remains our key challenge. With life expectancy increasing and final salary pension provision declining, we must now turn our attention to helping customers grow bigger pots.”

|