-

Over half (54%) of unretired over 55s who plan to continue work don’t feel old enough to retire

-

Gulf emerges between those who choose and those who need to work in later life, as 44% say they need to keep working to supplement their pension

-

23% of people worry about health implications of a longer working life on their relatives

More than a third (34%) of over 55s plan to continue working past what would previously have been considered their “retirement” age of 65, new figures from Scottish Widows think tank the Centre for the Modern Family have revealed.

Life Choice versus No Choice

The number of over 65s choosing to continue to work has risen 26% to 1.1 million since the abolition of the default retirement age in October 2011, and despite the difficulties facing many ‘pretirees,' a growing number of older workers are taking the changes to legislation as an opportunity to continue working for their own wellbeing. The Centre for the Modern Family research found a significant gap between those who want to carry on working versus those who need to continue earning.

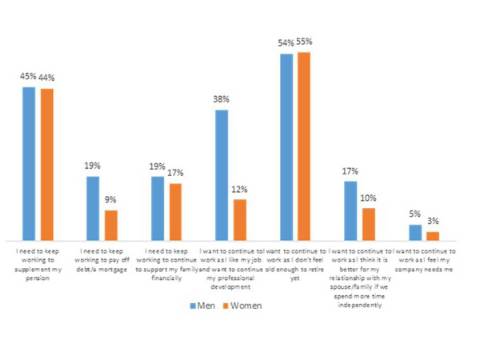

Over half (54%) of those who choose to stay in employment said that they don’t feel ‘old’ enough to retire, and 24% want to keep working because they enjoy their job and want to continue their professional development. The study highlighted that one in five men (17%) and one in 10 women felt improvements in family relationships as a result of spending more time independently.

The changing shape of the family unit has also impacted the possibility of retirement for many over 55s, with ageing relatives and boomerang children adding financial pressure at both ends of the spectrum. Almost a fifth admitted that they will continue to work in order to support their family financially, yet 17% felt their ability to do their job is impacted because they are tired and stressed from balancing work and family life.

Almost half (44%) of over 55s who plan to continue working also said they will need to do so in order to supplement their pension, and a further 13% still have debt or a mortgage to pay off. More than half (54%) of over 55s admitted that they are already struggling to make ends meet and have had to adjust their spending habits before considering life on a pension. Almost a quarter (23%) say they have spent their savings or contribute less to savings now (24%) as a result of living costs in the last year, while a third (33%) have cut down on leisure spending.

Reasons for continuing to work, by gender

Family fears over the impact of a longer working life

Regardless of the motive for continuing or returning to work, feelings amongst family members are yet to catch up with the attitudes of the workers themselves. This suggests that older workers are juggling competing priorities as they try to balance the demands of their finances, family life, health and jobs.

The research highlighted that 23% of people worry about the health implications of working longer for their ‘older’ relatives. Family members also worry that for older relatives, choosing to work for longer could have a negative impact on their family, with 18% saying they feel older and younger generations will have less time to spend together as a result. Almost one in 10 (9%) said it would make managing their own work and family life balance more difficult, a figure which rises to 13% among parents with children under 18.

However, positive signs are emerging that families can spot the benefits of a longer working life, both on health and family relationships. More than a quarter (27%) feel that older relatives will be able to remain active for longer, whilst 23% feel they become good role models for younger generations. Almost one in 10 (8%) also feel it will relieve the burden of financially supporting older relatives later in life.

Jackie Leiper, Director of Employer Relationships, Lloyds Banking Group, said: “As the face of Britain’s workforce continues to evolve, we need to step back and ask ourselves if we are truly embracing this change and meeting the changing needs of a generation of people who are continuing to work beyond the age of 65 whether out of desire or necessity. A more diverse and flexible workforce brings significant potential for us to increase our productivity and competitiveness as a nation. However, we will only make it a success if we fully support employees finding the right balance between work and family commitments later on in their working lives.”

|