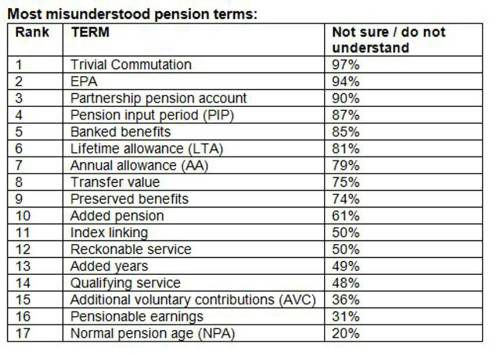

‘Trivial commutation’ is the term that most pension scheme members (97%) don’t understand. This was closely followed by EPA (effective pension age) by 94% of members and ‘partnership pension account’ by 90% of members. The term most people (80%) said they understood was ‘normal pension age’, followed by ‘pensionable earnings’ (69%) and ‘additional voluntary contributions’ (64%).

When members were asked how well they understand their pension in general, on a scale of 1 (not at all) to 10 (understand completely), the average score across all respondents was 5.79. Using the same scale, in terms of how important their pension is, members on average rated this 9.39.

Additionally research by MyCSP amongst over 100 pension members found that almost half (49%) of people aged between 50-59 have not given any thought to pension planning. This included 50% of men and 49% of women.

In support of National Pension Awareness Day on 15th September, MyCSP hosted roadshows from 12th – 16th September across the country, visiting 6 locations in 5 days from Swansea to Edinburgh. These sessions, for pension scheme members, are part of MyCSP’s ongoing programme and commitment of simplifying and clearly communicating pension information for members. During the roadshow MyCSP launched a fun online quiz called ‘Are you Pensions Savvy?’, designed to engage members and get them thinking about their pension and next steps.

David Boardman, Communications Director, MyCSP, said, “Pensions can be complicated. However, as an industry we haven’t done well in increasing peoples understanding and in part this is due to the terminology used and failing to explain things in a way that everyone can understand. The issue is not about simplification of pensions, it’s about trying to find ways of communicating and explaining the various products and services and how they relate to an individual’s retirement. For example, our commitment to help demystify the world of pensions has included a clear glossary of terms, bite-sized information and quick-start guides. Furthermore, our experience of addressing this issue over the last two years is that one size doesn’t fit all and communications needs to be as targeted as possible to the individual pension scheme member.”

|