More than a fifth (22%) of pension savers admit they don’t check their pension annually because they don’t know what they should be doing

One in seven don’t know where to access their pension information (16%)

This Pension Engagement Season, Standard Life provides tips for reviewing pensions and staying on top of admin

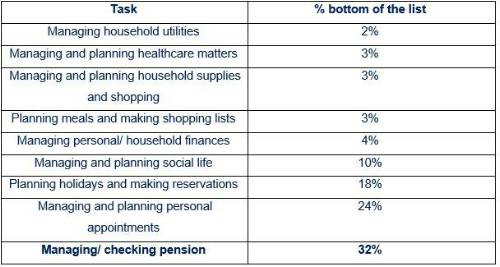

Pension Engagement Season is in full swing, however pensions rank bottom of Brits’ ‘Life admin’ to-do lists, according to new research from Standard Life, part of Phoenix Group, with a third (32%) saying it’s their lowest priority admin task, despite the impact it has on people’s futures.

Pension paperwork falls behind managing personal appointments with hairdressers or beauticians, with 25% putting this in last place, while 18% say planning holidays is last on their to do list.

Brits’ life admin priorities

Pensions left unreviewed because people don’t know what they should be doing

Even when consumers get around to pension admin, Standard Life’s research found that more than a quarter (27%) only check their pension once a year or even less frequently, while 14% admit they’ve never even looked at theirs.

Among those who don’t check their account at least every year, a fifth (22%) say this is because they don’t know what they should be doing. Worryingly, this rises to a third (34%) of 35 – 54 year olds, compared to 26% of 18 – 34 year olds and 11% of over 55s.

Meanwhile, 16% of those who check the pension less than once a year say it’s because they don’t know where to access the information, while 15% simply say they don’t know how to check it. In addition, 13% don’t believe they have enough savings to engage with their pension and 12% don’t review theirs because it’s overwhelming.

Gail Izat, Managing Director for Workplace Pensions at Standard Life, part of Phoenix Group said: “Sorting out your pension is one of those things that can easily fall to the bottom of the to-do list, however like any life admin task there’s a feeling of satisfaction when it’s done, and in reality taking a few basic steps to pay your pension some attention doesn’t need to be a major task. We know that people who actively engage with their retirement saving throughout their financial lives give themselves a huge head-start even simply by knowing how much they have saved and what they are likely to be able to afford in retirement. If you’re armed with this basic information you’ll then have a chance to make a plan to address any under-saving before it’s too late, or manage your future spending expectations. You’ll also be able to check if your investments are working for you, look at whether you could benefit from bringing all your pensions into one place and make sure your beneficiaries are up to date so it’s easier for your loved ones to access your pension if you pass away. Setting up digital access so you can quickly interact with your pension on the go can make checking your pension even easier.”

“Employers and pension providers can help people stay on top of their long-term savings by introducing engaging and targeted communications at each stage of life and, crucially, showing how pension saving forms part of people’s wider financial wellbeing - one piece of the bigger financial jigsaw.”

|